Forestry as an asset class

Characteristics of the asset class

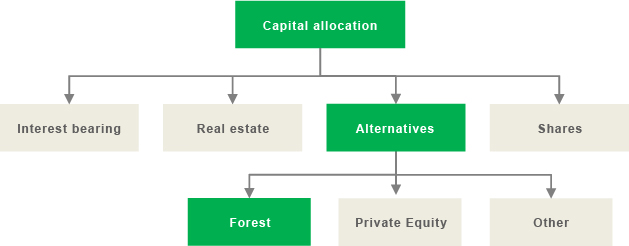

- In recent years there has been an increased interest in alternative investments, with forestry as one of the asset classes

- Forestry offers an opportunity to diversify and therefore forms a natural component in a broad, long-term investment portfolio. Investing in forestry, especially direct investment, has a low correlation with the stock market and offers less volatility than other asset classes.

- A stable, secure and sustainable cash flow is characteristic of the forestry sector.

- Cash flow is generated for the most part by net earnings from forestry activities (Skogsnetto), which over the past ten years has exceeded the rate of inflation.

In recent years, wind power has entered on a broad front, mainly in northern Sweden and Finland, which through land leases adds to cash flow. - The return on forestry investment consists of two parts: a direct return (cash flow component) and value growth.

- Value growth is determined by supply and demand, price changes and changes in the growing stock and its composition.

Categorisation of factors that influence investment willingness in the forestry industry

Investment factors

The yield profile and characteristics of forestry investments:

- Stable yield

- Value growth

Market factors

Timing and market conditions that favour increased exposure to alternative investments:

- Volatile stock market

- Nonexistent or negative return on interest-bearing investments

Variation between geographic markets

- The price of forest real estate will vary depending on forest type, geographical location and timber volumes.

- Prices vary in Sweden with the highest prices found in southern Sweden. This is an effect of a limited supply coupled with a high demand for forest real estate, which is not only regarded as an investment but is often acquired for other purposes, for example as a dwelling and for hunting purposes. The price of forest real estate is thereby influenced by the price of forest products and the attractiveness of the land.

- In Estonia, Latvia and Lithuania, forest products are of the same quality as in the Nordic region in general, but property prices in these countries are significantly lower.